Congratulations!! You’ve prepared yourself and your family for the future. Creating a Last Will and Testament (preferably in conjunction with a Revocable Trust and Advanced Directives) is a huge accomplishment. But even if you already have an estate plan, you’ll want to examine these documents periodically to make sure they continue to reflect your wishes.

At the very least, your estate plan should be reviewed and possibly revised any time you experience a major life change, such as:

- Loss of a Spouse

- Divorce or Remarriage

- Death of a Beneficiary

- Birth of Children

- Birth of Grandchildren

- Major shift in assets, such as the sale of real estate or a business

- Significant change in the health of your proposed Personal Representative or Trustee

- Maturation of long-term investments

- Changes in estate tax laws that affect the distribution of your assets or possible estate taxes

- Changing relationships with family members or other individuals you have included in your estate plan.

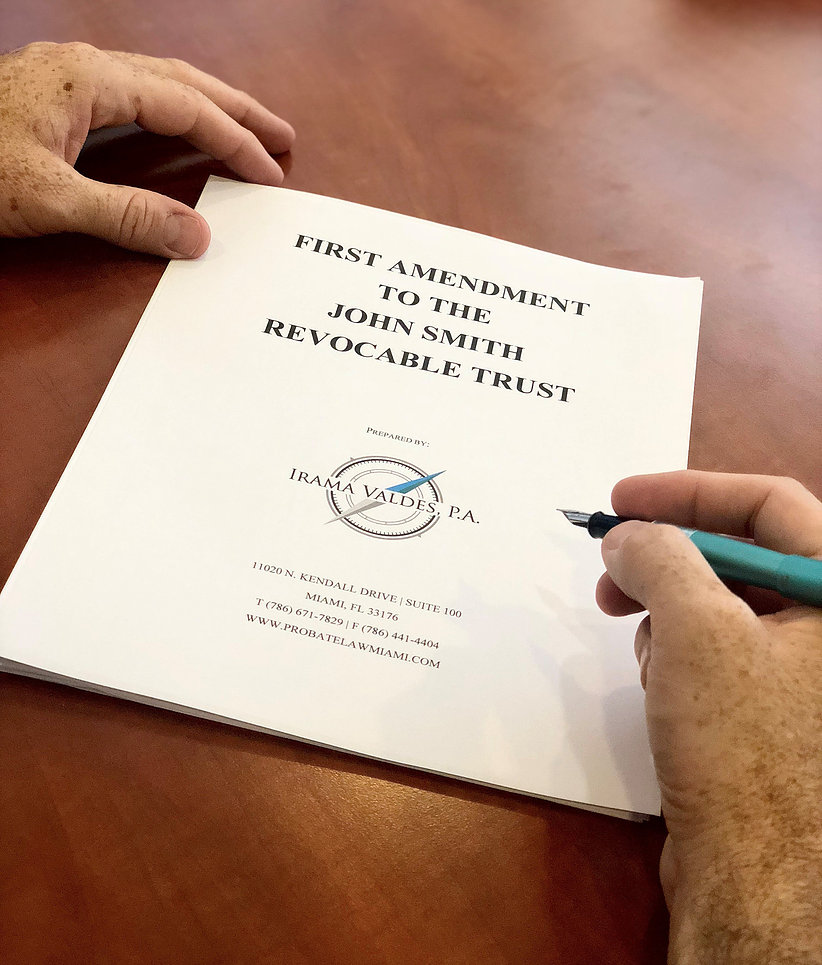

Just as your life, your family dynamic, and your assets change, your estate plan should be amended to appropriately match your current wishes. When needed, revisions can be address through an Amendment to your Trust or a Codicil to your Will (codicil is just a fancy word for modification). This is a simple process and the document is read in conjunction with the original existing estate plan. As usual, I recommend seeking professional advice from an attorney when preparing or amending your estate plan.