When you think hurricanes, you think Estate Planning, right?

Oh wait, I guess that’s just me.

Hurricanes bring about destruction, loss of power, short supply, and, well, I can’t help but compare this to a heavily litigated Probate or Guardianship case. When an estate that does not have an effective plan falls into Probate, or when someone becomes incapacitated and a Guardianship is necessary, it can:

- Destroy relationships between family members

- Remove power from relatives taking good care of the incapacitated person

- Remove power over the Decedent’s assets until a Personal Representative is appointed

- Decrease the amount of assets an incapacitated individual has

- Decrease the Estate’s assets by attorneys’ fees, especially when there is litigation or creditors

- and so much more…

Having an Estate Plan can help prevent possible disasters that can be caused by a hurricane. An ounce of prevention is worth a pound of cure.

So, why is having an estate plan important, especially in the face of a hurricane?

Incapacity:

If you are injured during the Hurricane, your estate plan will contain a series of important documents to appoint and assist your trusted family and friends in making medical and financial decisions on your behalf until you recover, for example, a Durable Power of Attorney will name someone to manage your finances, pay your bills, liquidate assets to pay for medical expenses, etc. With a Healthcare Surrogate you designate a person you trust to make medical decisions for you if you cannot make decisions for yourself.

Death:

God forbid the worst happens, and you pass away. In addition to your relatives grieving your untimely death, they now have to deal with your assets when normal financial, legal, and other resources may be scarcely available. Things are already a mess during a hurricane… don’t add to it by leaving behind legal issues which can affect your children or loved ones.

Funeral Arrangements

If the worst-case scenario occurs, you want to have your funeral, as well as burial and cremation, prepared. That way, your family has an easier time making the arrangements and can focus on grieving and spending time together.

If you have already created an estate plan, follow these tips to make sure your plan is effective:

- Keep them safe: Make sure all legal documents are kept in a waterproof, fireproof safe or location. If you have a safe deposit box, it may be a good idea to place your legal documents inside your box. Speak with your banker to make sure the banking institution has procedures in place for protecting their safe deposit boxes in the event of a natural disaster.

- Paper Copies: Give paper copies of your documents to those listed in them. You may not have access to the internet or a computer if and when you lose power and you may need to produce these documents in the event of a medical emergency.

- Digital Copies: In today’s modern world, many institutions will take a digital copy of a document, so make sure your documents are scanned and saved to several locations or a trusted cloud source in the event that they are destroyed by the effects of the hurricane.

We’d love to make sure you’re prepared, so feel free to give us a call at (305) 477-1111 to schedule your initial consultation today. If you’d like to begin the process, select one of the following questionnaires to get started:

If you’re single, download this estate planning questionnaire: Estate Planning Questionaire (Single)

If you’re married, download this estate planning questionnaire: Estate Planning Questionnaire (Married)

OR you can access our questionnaire online at: START THE PROCESS

We hope all our friends, family, and clients stay safe during this hurricane. Here are some helpful links:

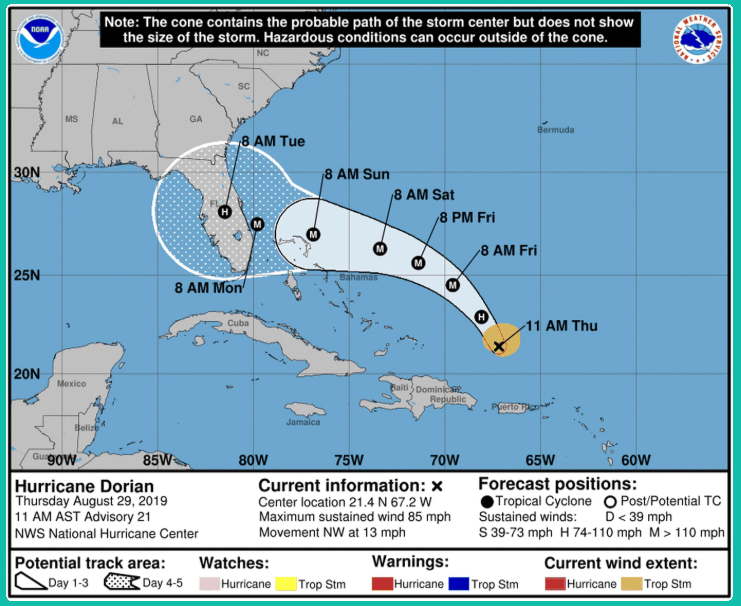

National Hurricane Center: https://www.nhc.noaa.gov/

AccuWeather: https://www.accuweather.com/en/hurricane/tracker